On Wednesday, the EUR/USD currency pair continued the upward movement that began on Tuesday. Recall that on Tuesday, the U.S. released a high-profile report with no truly high-profile implications. U.S. inflation did not accelerate in July, which came as a complete surprise to traders who had expected a slight increase, while also keeping in mind far more pessimistic scenarios.

Jerome Powell "stirred the pot" in recent months by constantly repeating the same message: U.S. inflation will rise. His words can be interpreted in many ways. On one hand, Powell is correct because inflation has indeed been rising in recent months. On the other hand, Donald Trump is also correct in noting that inflation remains relatively low. On the other hand, the "doves" within the Federal Reserve are correct in believing that Trump's tariffs will not trigger strong and sustained inflation. And from a fourth perspective, inflation currently does not matter much at all since the Fed will cut the key rate in September regardless. This is the kind of puzzle traders have had to solve this week.

In recent weeks, we have repeatedly said the same thing: the U.S. dollar had been correcting for an entire month, but then it was time for a new extended decline. Therefore, we are not at all surprised that the U.S. currency is once again under market pressure. Why wouldn't it be? Has the trade war ended? No. Has the Fed abandoned monetary policy easing? No. Has Donald Trump stopped imposing tariffs on every country he can recall? No. Has Donald Trump changed his mind about wanting a "weaker dollar"? No. Has Trump stopped criticizing and firing the Fed Chair every week? No. Has the U.S. president given up on cutting the key rate? No. To this list, we can also add the quite possible peaceful settlement of the military conflict in Eastern Europe, which would also be negative for the dollar.

Why would ending the war in Ukraine be bad for the dollar? Because the dollar is still considered a "safe-haven currency" and "reserve currency." Demand for it rises when a new conflict emerges or an old one escalates. In the opposite scenario, investors and traders tend to move toward riskier assets and currencies. Thus, an end to the war in Ukraine = another drop in the dollar.

Now, try to find even one reason for the U.S. currency to grow in the near term. Some time ago, the GDP report gave a reason for optimism, but just a few days later, labor market data erased all of it. About a month ago, Trump signed a trade agreement with the European Union, and many might have thought this was the "beginning of the end" of the trade war. But the U.S. president quickly dispelled such hopes, imposing tariffs against another 50–60 countries over the next couple of weeks, as well as raising tariffs on copper. The conflict with China continues, even though the sides agreed to extend the "tariff truce." We have not seen any positive news for the dollar, and still do not. Therefore, we expect further upward movement in EUR/USD.

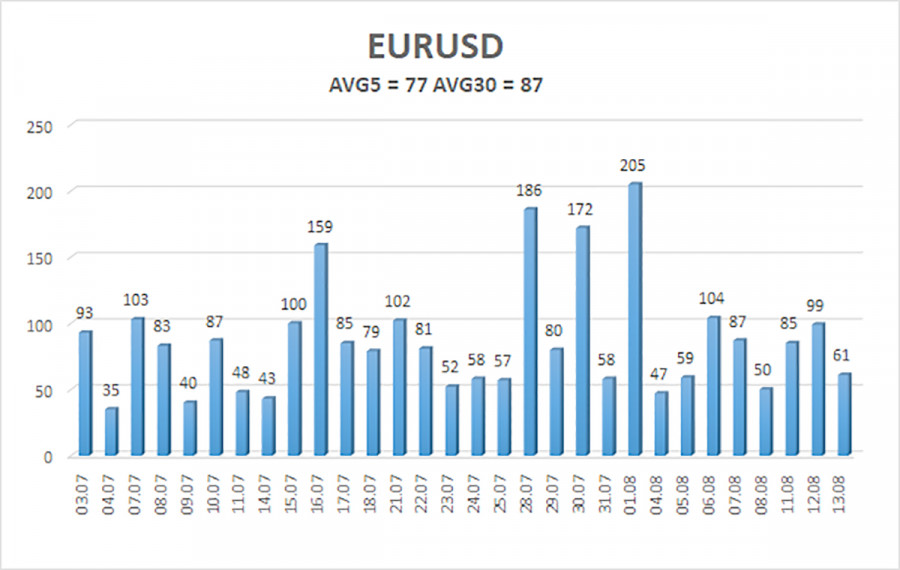

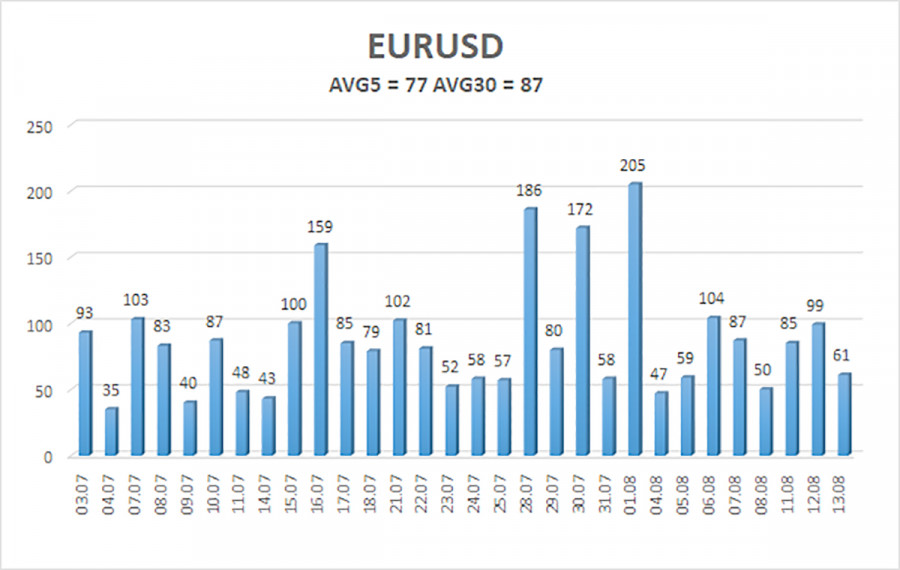

The average volatility of the EUR/USD currency pair over the past five trading days, as of August 14, is 77 pips, which is considered "moderate." We expect the pair to trade between the levels of 1.1632 and 1.1786 on Thursday. The long-term linear regression channel is pointing upward, which still indicates an uptrend. The CCI indicator has entered the oversold area three times, signaling the resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The U.S. currency continues to be heavily influenced by Trump's policies, and he shows no sign of "slowing down." The dollar has grown as much as it could, but now it seems time for a new prolonged decline. If the price is below the moving average, short positions can be considered with targets at 1.1597 and 1.1536. Above the moving average, long positions remain relevant with targets at 1.1780 and 1.1786, in line with the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.