Market closes with gains

US stock indices closed Wednesday with solid gains, driven by an especially sharp surge in the Nasdaq, which added more than 1%. The main drivers were strong corporate earnings and major news from tech giants.

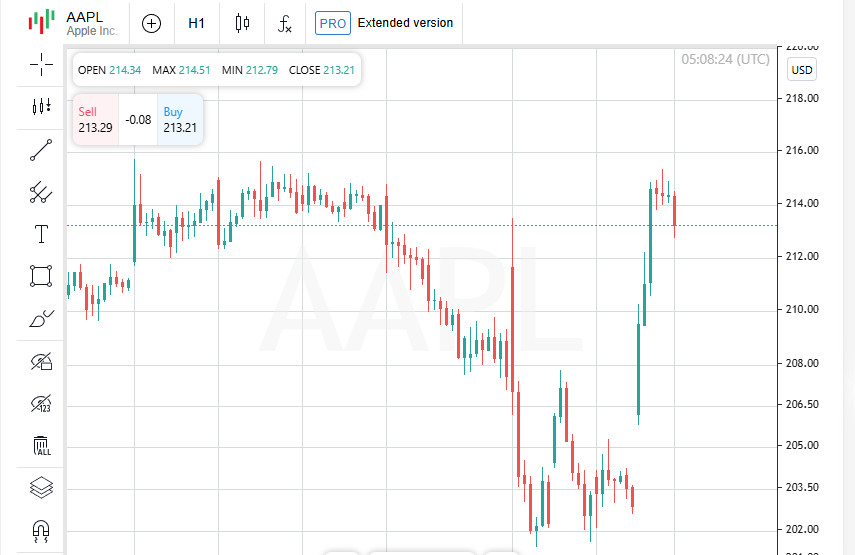

Apple soars on investment announcement

Apple shares surged by an impressive 5.1%. The rally was triggered by a White House official's statement that the company plans to invest $100 billion in expanding domestic production in the US. This news sparked an immediate positive reaction from investors, strengthening Apple's presence across all three key indices.

McDonald's surprises with global demand

McDonald's shares rose by 3% after the company reported that its value menu significantly exceeded analyst expectations for global sales. This was taken as a sign of resilient consumer demand amid ongoing economic uncertainty.

Arista Networks surges

The most striking gain came from Arista Networks, whose shares surged by 17.5%. The cloud technology company issued an upbeat revenue forecast for the current quarter, beating market expectations.

Earnings season breaks records

To date, around 400 companies from the S&P 500 have reported second-quarter results. According to LSEG data, roughly 80% of them exceeded analyst profit forecasts — above the four-quarter average of 76%. Earnings growth for the reporting period reached 12.1%, more than double the July forecast of 5.8%.

Major stock indices at session end:

- The Dow Jones added 81.38 points to close at 44,193.12, notching a gain of 0.18%;

- The S&P 500 rose by 45.87 points, or 0.73%, reaching 6,345.06;

- The Nasdaq Composite strengthened by 252.87 points to finish at 21,169.42, marking a 1.21% increase.

Investors bet on rate cuts

Market optimism was fueled by growing expectations of a Federal Reserve policy shift. The latest jobs report showed a slowdown in hiring and downward revisions to previous months' data — all of which reinforced investor belief in a rate cut as early as September.

According to CME FedWatch data, the probability that the Federal Reserve will cut rates by 25 basis points this fall has risen to 95.2%. For comparison, this figure stood at 92.9% the day before, and only 46.7% a week ago.

AMD and Super Micro disappoint investors

Despite the broader optimism, the market faced some unpleasant surprises. Shares of Advanced Micro Devices fell by 6.4% after weak results in the data center segment. Super Micro Computer performed even worse — its stock plunged by 18.3%.

Disney delights but loses

Despite strong quarterly results and an upgraded full-year forecast, Disney shares ended the session down 2.7%. Investors remained cautious despite the positive report.

Fed and Trump's decision in focus

An additional factor of uncertainty remains the anticipated announcement from Donald Trump regarding the appointment of a new member to the Federal Reserve Board of Governors. Markets are closely watching potential personnel changes at the country's leading financial institution.

Japanese indices set all-time records

Asian stock markets ended Thursday with solid gains, with Japanese exchanges taking center stage. The Topix index rose by 0.9%, setting an all-time high, while the Nikkei added nearly as much. The optimism was driven by a surge in tech stocks on Wall Street, strong corporate earnings, and a shift in expectations regarding US monetary policy.

Taiwan and South Korea reinforce uptrend

Taiwan's stock market also posted an impressive rally. The TWII index gained 2.3%, reaching its highest level in over a year. South Korea's KOSPI rose by 0.6%, continuing its climb amid a favorable global backdrop.

China and Hong Kong post modest gains

Hong Kong's Hang Seng index added 0.4%, while China's CSI300 strengthened by 0.3%. Despite the more restrained performance, investors remain cautiously optimistic about mainland China's economic trajectory.

Australia eases slightly

The Australian market showed a slight decline after reaching a historic peak the day before. The pullback appears to be technical in nature and did not significantly dampen overall sentiment.

Sterling steady ahead of BoE decision

The British pound remained stable at 1.3356 USD, reaching a weekly high. Investors took a wait-and-see approach ahead of the Bank of England meeting. Market participants widely discussed the likelihood of a 25 basis point rate cut, as well as potential internal disagreements within policymakers.

Dollar weakens, focus shifts to Fed

The US currency lost ground against other major currencies. Market participants are closely watching signals from the Federal Reserve. In light of weak jobs data and rumors of potential new appointments by Trump, expectations have grown that the Fed may adopt a more dovish stance. The possible new members of the Board of Governors are likely to support a moderate course in line with the former president's views.

Dollar rebounds after sharp sell-off

Following a notable 0.6% decline in the previous trading session, the US dollar index posted a modest gain, reaching 98.245. This index tracks the US currency's performance against six major counterparts, including the euro and the pound.

Euro holds steady after steep rally

The single European currency remained virtually unchanged, holding at 1.1657 USD. A day earlier, the euro had strengthened significantly, adding 0.7% amid dollar weakness.

Bank of England faces tough decision

Investors are holding their breath ahead of the Bank of England meeting. The regulator may implement a fifth key rate cut this year, though the decision appears far from unanimous. A split is expected within the committee: some members are leaning toward a more aggressive 50-basis-point cut, while others favor maintaining the current level due to inflation concerns.

Yen loses some ground

The US dollar strengthened against the Japanese currency, gaining 0.1% to reach 147.53.

Gold gains on weaker dollar

Gold prices climbed by 0.4%, reaching approximately $3,382 per ounce. The primary driver of the rally was the temporary weakening of the dollar, which made the precious metal more attractive to investors.

Oil recovers some of its losses

After a notable decline the previous day, when Brent and WTI crude lost around 1%, oil prices rebounded slightly on Thursday. Brent futures rose by 20 cents to $67.09 per barrel, while WTI gained 22 cents to reach $64.57 per barrel. This supported sentiment in the commodity market despite overall volatility.