Wall Street surges: all three major US indices post sharp gains

The US stock market started the week with strong upside momentum. On Monday, all three key US indices recorded their biggest single-day gains since late May, reacting to softening macroeconomic data and growing hopes for an imminent base rate cut.

Buying the dip after Friday's sell-off

Investors rushed to take advantage of lower prices after Friday's sell-off, snapping up assets at more attractive valuations. Adding to the optimism were weak employment data released earlier, reinforcing expectations of monetary policy easing in the coming months.

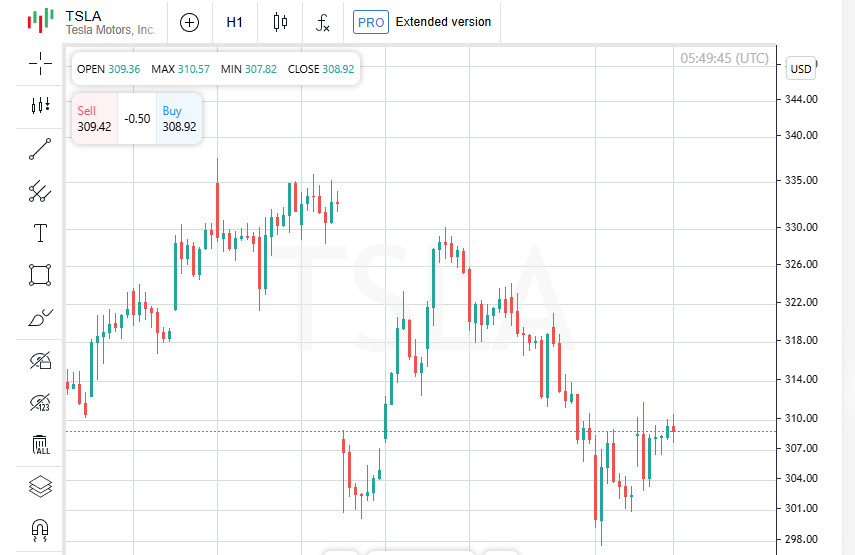

Tesla climbs as Musk receives massive stock grant

Tesla shares rose by 2.2% after news broke that Elon Musk had been granted an option package worth 96 million shares, valued at roughly $29 billion.

Betting on rate cuts: Fed under pressure

According to CME FedWatch data, the probability of a rate cut in September stands at 84%. The market is pricing in at least two 25-basis-point cuts by year-end.

Indices keep setting records

Stock indices continue to set new all-time highs. On Monday, the Dow Jones rose by 585 points, or 1.34%, reaching 44,173. The S&P 500 gained 91 points (1.47%) to hit 6,330, while the Nasdaq added nearly 403 points to close at 21,054, marking a 1.95% gain.

Personnel reshuffles in Washington

The political scene has also affected investor sentiment. US President Donald Trump dismissed Bureau of Labor Statistics Commissioner Erica MacEntarfer, accusing her of deliberately understating employment figures.

On the same day, Federal Reserve Governor Adriana Kugler unexpectedly resigned, potentially increasing Trump's influence over the central bank's future policy. The president has long criticized the Fed for its refusal to cut rates and continues to demand action.

Trade tensions with India

Trump also announced a significant increase in tariffs on imports from India, citing New Delhi's continued purchases of Russian oil. Indian authorities have already stated their intention to defend their interests, calling the US actions "unjustified."

Investors await final earnings: market reacts to key developments

Although the US second-quarter earnings season is drawing to a close, market participants remain focused on upcoming reports. Particular attention is on Walt Disney's earnings, which could influence overall sentiment.

Spotify hikes prices — shares soar

Shares of streaming giant Spotify surged by 5% after the company announced a price increase for individual Premium subscriptions in several countries. The new pricing will take effect in September, and analysts view the move as a potential boost to the platform's profitability.

Joby Aviation expands through Blade deal

The biggest spotlight on Monday was on Joby Aviation shares, which jumped by nearly 19% following news of its acquisition of Blade Air Mobility's passenger business. The deal could be worth up to $125 million. Shares of Blade Air also rallied on the news, rising by 17.2%.

Berkshire Hathaway loses value amid weak earnings

Meanwhile, Class A shares of investment conglomerate Berkshire Hathaway, led by Warren Buffett, dropped by 2.7%. The decline followed the release of weak quarterly operating results and a statement regarding asset write-downs totaling $3.8 billion.

Asian markets strengthen as investors bet on Fed easing

For the second day in a row, Asia-Pacific stock exchanges are showing gains, while the US dollar continues to hold recent losses. Market optimism is rising amid expectations that the Federal Reserve may shift toward a more accommodative policy to support the US economy.

Japan's services sector rebounds

Japan's Nikkei index rose by half a percent, recovering losses from the previous day, when it recorded its steepest drop in two months. The market was supported by improved business activity in the services sector: the July S&P Global Services Business Activity Index climbed to 53.6 from 51.7 in June, marking the highest reading since February.

Broad regional growth

The MSCI Asia-Pacific index excluding Japan gained 0.6% in early trading. Positive sentiment also spread across other regional markets, supported by improving macroeconomic indicators and steady demand for technology stocks.

Currencies: dollar weakens but holds ground

The US dollar declined by 0.1% against the yen, falling to 146.96. The euro remained steady at $1.1572. The US dollar index, which tracks the currency against a basket of major peers, edged up by 0.1% after two straight sessions of declines.

Political factor: Trump's return raises concerns

Markets reacted to reports of a possible early appointment of Donald Trump as head of the Federal Reserve. This news intensified fears that monetary policy could come under political influence.

Tech giants rise: technology back in focus

The US market saw continued growth in shares of major tech players. Nvidia and Alphabet stocks advanced confidently. At the same time, Palantir Technologies raised its revenue forecast for the second time this year, expecting sustained demand for its artificial intelligence solutions.

Oil remains under pressure amid geopolitics and rising output

Global oil prices continue to show weak performance as the market digests OPEC+'s decision to increase output along with tough rhetoric from US President Donald Trump, who threatened India with higher tariffs over its imports of Russian oil.

Brent moves steadily

Brent crude futures held at $68.76 per barrel. US light crude slipped by 0.02% to $66.28 per barrel. Oil prices remain under pressure due to supply surplus and heightened political risks.

Gold edges up

Against the backdrop of geopolitical tensions and commodity market fluctuations, spot gold prices posted a moderate gain, reaching $3,381.40 per troy ounce.

European and US stock markets express cautious optimism

Futures for European indices showed modest growth: Euro Stoxx 50 gained 0.2%, Germany's DAX rose by 0.3%, and the UK's FTSE added 0.4%. The US S&P 500 e-mini also increased by 0.2%, reflecting investor sentiment aiming for stability amid foreign policy uncertainty.

Cryptocurrency sees no sharp moves

Bitcoin's price remained virtually unchanged at $114,866.06. This comes after a two-day rally, with the digital asset now consolidating without a clear trend.