Analysis of Monday's Trades

1H Chart of GBP/USD

The GBP/USD pair also showed no significant movements on Monday, although it did demonstrate a slight upward bias. Volatility was virtually zero, so there was no real point in trading that day. Of course, it was impossible to predict in advance that the market would enter a total flat mode after Friday's news-heavy session, but by the time the European trading session opened, it became clear that no major moves were to be expected. That said, a few decent trading signals were still formed, which we'll discuss below.

As for Monday's macroeconomic and fundamental background, there was nothing noteworthy. However, we believe that the overall fundamental backdrop still favors the British pound. The Bank of England may cut the key interest rate for the third time this year later this week, but we still doubt that such a decision will be made. Nonetheless, a rate cut is a bearish factor for the British currency — this should be acknowledged and kept in mind. That said, many more factors are weighing down on the U.S. dollar.

5M Chart of GBP/USD

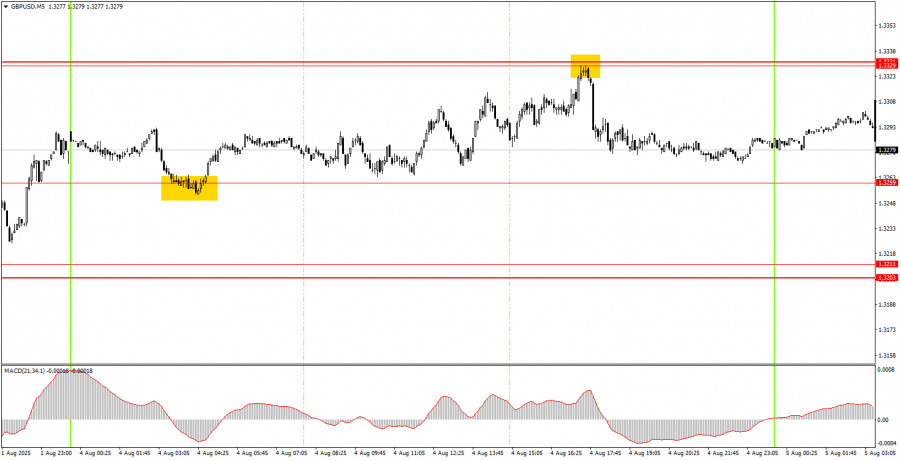

On the 5-minute timeframe, two excellent trading signals were formed on Monday. During the night, the price bounced off the 1.3259 level, and by the time the European session opened, it had not moved far from the point of signal formation. Thus, a long (buy) position could have been opened. During the U.S. session, the price reached the 1.3329–1.3331 area, from which a bounce followed. Therefore, novice traders also had the opportunity to open short (sell) positions. Both trades turned out to be profitable.

Trading Strategy for Tuesday:

On the hourly timeframe, GBP/USD suggests that the downward technical correction is likely over. After Friday's news, we wouldn't have bet a penny on the growth of the U.S. currency. The price has consolidated above the descending channel, so the trend on the hourly timeframe has turned upward.

On Tuesday, GBP/USD may continue its upward movement. Therefore, any support level is potentially a bounce point and a signal to resume the northward move.

On the 5-minute chart, the following levels can be used for trading: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466, 1.3518–1.3532, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763.

There are no important data releases or events scheduled for Tuesday in the UK. However, in the U.S., the ISM Services PMI will be published. As a reminder, the manufacturing sector disappointed on Friday, but in recent years, the services sector has performed better.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.