On Friday, global financial markets were hit by a double blow that could have a significant impact on the broader market outlook.

On the morning of August 1, as promised by the U.S. President, new import tariffs ranging from 10% to 41% for countries trading with the U.S. came into force. Although markets were expecting this, a gradual decline began across all markets without exception. Only gold and government bond prices began to edge higher. The drop was relatively moderate at first, and there were no signs of the sharp sell-off that would later unfold and potentially change the market landscape. But as they say, surprises come from where you least expect them. The July U.S. jobs report turned out to be not just disappointing—but extremely negative. It showed that, contrary to Donald Trump's claims, the U.S. economy has begun to feel the adverse effects not only of tariff wars but also of the current administration's immigration policies, which are limiting growth in low-wage jobs typically filled by migrants from Mexico, Central, and South America.

According to the data released, the U.S. economy added only 73,000 jobs in July, well below the forecast of 106,000. Even worse, job growth figures for June and May were revised significantly downward. These developments indicate that the U.S. economy is facing serious problems, with persistently high interest rates and an inflation rate that remains well above the Federal Reserve's 2% target.

As noted above, market participants were shocked by this news, which triggered a broad sell-off. At the same time, the data also provided a basis for economists and investors to reconsider the Fed's interest rate outlook. Futures on federal funds rates showed a sharp shift in expectations. While the probability of a rate cut in September had previously been low—mainly due to Jerome Powell's cautious stance—the dismal labor market report pushed expectations sharply higher, with more than an 80% chance of a 0.25% rate cut in September, bringing the range down to 4.00–4.25% from the current 4.25–4.50%.

Is a rate cut in September likely?

The market believes so, and I agree. Powell may have no choice. He is already being criticized for his overly cautious monetary policy stance. This criticism could intensify in August, making it harder for him to resist. One key signal pointing toward a likely rate cut is the drop in U.S. Treasury yields. The benchmark 10-year yield fell to 4.200%, indicating that markets have started pricing in a September rate cut. However, the bond market sell-off was also driven by an emotional decision by Donald Trump to fire the Commissioner of the Bureau of Labor Statistics, Erica McEntarfer, accusing her of data falsification.

Is there a risk of the Friday market collapse continuing?

There's certainly no shortage of negative catalysts: Trump's new tariffs, the risk of the U.S. economy slipping into recession—as suggested by the labor market—and the president's impulsive actions that continue to fuel uncertainty. However, the market may have already largely priced in the negativity, particularly given the labor data. Investors may now cling to one key hope—the prospect of Fed rate cuts. It's important to remember that a falling stock market is highly undesirable for the U.S., especially for major investors, companies, and corporations whose asset values shrink in such an environment.

Pressure on Powell is likely to grow not just from the president but also from powerful investor groups, which could help limit further stock market losses.

The correction may continue today, but there's also a chance of stabilization and a reversal based on renewed rate-cut expectations. This makes comments from voting FOMC members especially important this week, along with manufacturing data and the ongoing wave of corporate earnings reports.

Daily Forecast:

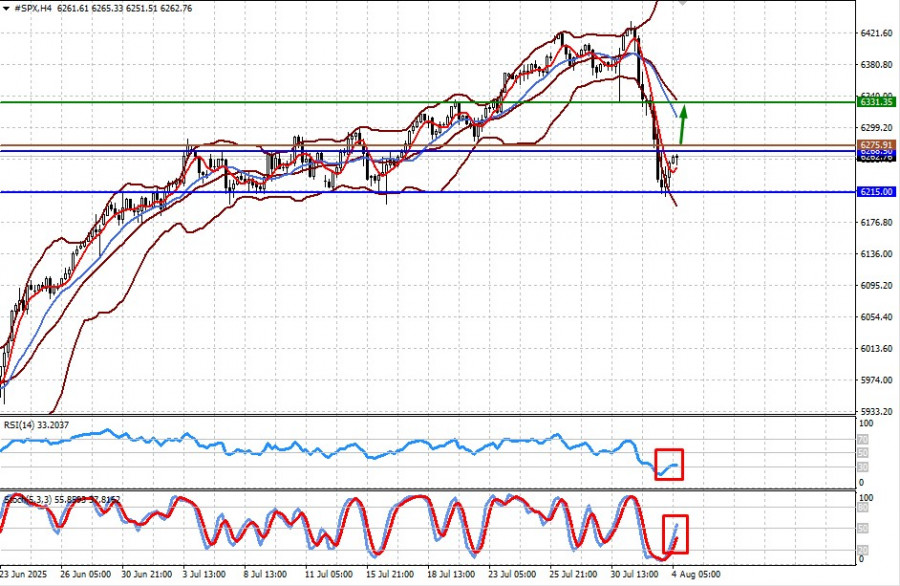

#SPX

The CFD contract on the S&P 500 futures is rebounding after a sharp fall on Friday. Renewed focus on labor market data and increased odds of a September rate cut could lift the contract to 6331.35 after breaking through 6268.50. A potential buy level could be around 6275.91.

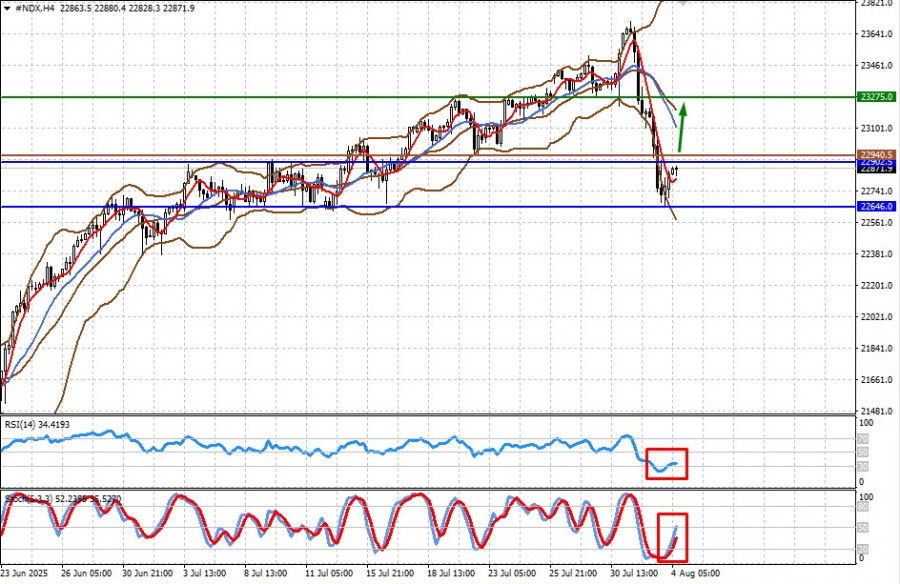

#NDX

The CFD contract on NASDAQ 100 futures is also recovering after Friday's collapse. Labor market concerns and rising expectations of a Fed rate cut in September could push the contract up to 23,275.00 after overcoming the 22,902.50 level. A potential buy level could be around 22,940.50.