Trade Review and Tips for the British Pound

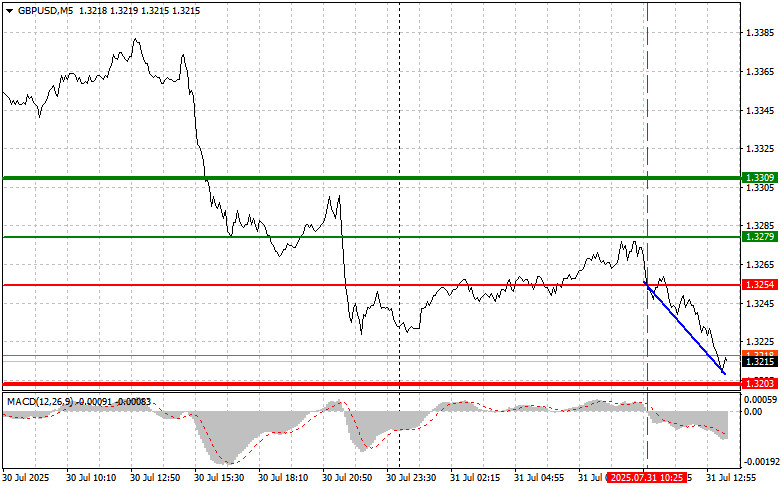

The test of the 1.3254 level occurred when the MACD indicator had just begun moving downward from the zero line, confirming the correct entry point for a short position on the pound and resulting in a decline of more than 40 points.

As expected, the pound showed a modest increase against the U.S. dollar in the absence of significant macroeconomic data from the UK, but then resumed its decline. Initial optimism, driven by hopes for a more cautious monetary policy stance from the Bank of England, quickly faded. Weak UK economic growth forecasts continue to weigh on the pound. Growing concerns about recession and inflation reduce the appeal of British assets. These combined factors have led to heavy selling pressure on the pound and its notable weakening against the dollar. The pair's future movement will largely depend on the UK's ability to stabilize the economy and restore investor confidence.

In the second half of the day, market focus will shift to the release of U.S. data on initial jobless claims and the core consumer price index. Additionally, updated figures on changes in personal income and spending will be published. These indicators are critical for understanding the current state of the U.S. economy and will undoubtedly have a significant impact on financial markets. A key event will be the release of the Personal Consumption Expenditures (PCE) index, one of the main measures of inflation. PCE reflects changes in prices for goods and services consumed by the population. A sharp rise in the index could prompt the Fed to tighten monetary policy, raise interest rates, and reduce its balance sheet, which in turn may weigh on stock markets. Changes in personal income and spending provide insight into consumer activity, which remains the main engine of U.S. economic growth.

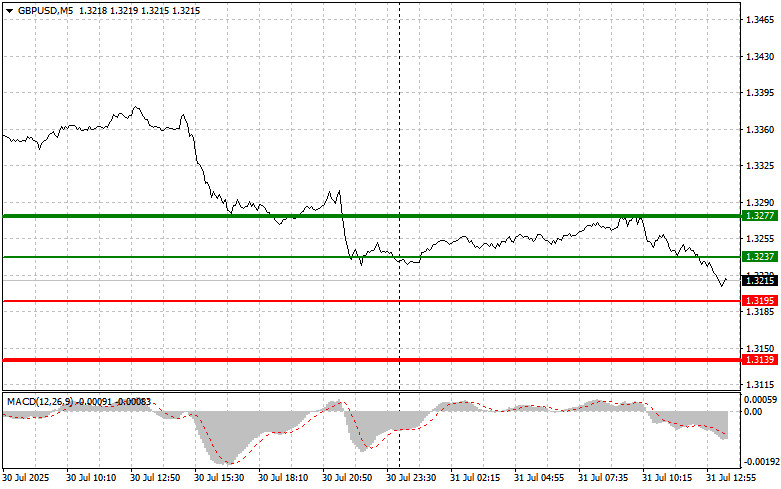

As for intraday strategy, I'll rely more on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches 1.3237 (green line on the chart), targeting a rise to 1.3277 (thicker green line). Around 1.3277, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 point pullback. A stronger pound can only be expected if U.S. data turns out weak. Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if the price tests the 1.3195 level twice in a row, while the MACD is in oversold territory. This would limit the pair's downward potential and may lead to a market reversal to the upside. A rise to the opposite levels of 1.3237 and 1.3277 may then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout below 1.3195 (red line on the chart), which would likely trigger a sharp drop. The key target for sellers will be 1.3139, where I plan to exit short positions and open long positions in the opposite direction (targeting a 20–25 point rebound). Sellers are ready to act at any opportunity. Important! Before selling, ensure that the MACD is below the zero line and just beginning to move down from it.

Scenario #2: I also plan to sell the pound today if the price tests the 1.3237 level twice in a row while the MACD is in overbought territory. This would limit the pair's upward potential and could lead to a market reversal downward. A drop toward 1.3195 and 1.3139 may then follow.

Chart Legend:

- Thin green line – entry price for buying the instrument

- Thick green line – estimated price to set a Take Profit or manually close a position, as further growth beyond this point is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – estimated price to set a Take Profit or manually close a position, as further decline beyond this point is unlikely

- MACD Indicator – when entering the market, rely on overbought and oversold zones

Important: Beginner Forex traders should be extremely cautious when making market entry decisions. It's best to stay out of the market ahead of major fundamental reports to avoid getting caught in sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Trading without stop-losses can quickly deplete your entire deposit, especially if you don't use proper money management and trade large volumes.

And remember: successful trading requires a clear and structured plan—such as the one provided above. Making spontaneous decisions based on current market sentiment is an inherently losing strategy for intraday traders.