The GBP/USD currency pair remained stagnant on Tuesday. During the U.S. trading session, there was a brief surge in activity, but it had little lasting impact. What could it have influenced when the most important events of the day were the JOLTS and ADP reports? The "headlines" of these reports may be loud, but what do they really represent? The ADP report has recently been published weekly, perhaps to somewhat fill the gaps created by the "shutdown." The shutdown ended a month and a half ago, yet relevant macroeconomic data is still lacking.

Clearly, the weekly ADP report is akin to weekly unemployment data—markets pay virtually no attention to it, as there are monthly figures like Nonfarm Payrolls and unemployment rates. Those data will be released next week and may cause market volatility. The JOLTs report was published for September and October. Who cares about data that is three months old?

In recent weeks, the British pound has appreciated by 300 pips and is now testing the Senkou Span B line on the daily timeframe, which we previously discussed. Once again, we need to refer to the 24-hour chart, as it currently provides the most comprehensive view of the market situation. On the daily timeframe, we see a strong upward trend and a prolonged correction, during which the dollar has recovered 45%. For now, we will not discuss the reasons behind the strengthening of the U.S. currency; let's just say there were a few, and we still consider the dollar's rise illogical.

The GBP/USD pair now faces a dilemma: should it embark on a new long-term correction and dampen traders' spirits for another couple of months, or should it resume the upward trend, which is fully justified by the macroeconomic and fundamental backdrop? If the pair confidently breaks above the 1.3364 level (the Senkou Span B line), we can discuss the resumption of the upward trend.

Wednesday's session could be a good day for the pound to soar, regardless of the decision made by the Federal Reserve and the rhetoric expressed by Jerome Powell. Recall how many times the Fed's decision pointed one way while the price moved in the opposite direction? The last two Fed meetings concluded with a "dovish" decision, yet the dollar remained steady for two months. Therefore, traders might be in for another surprise today. We do not know which course Jerome Powell and his colleagues will take in the coming months. Most likely, there will be no course, as key macroeconomic data on labor markets, unemployment, and inflation remain unavailable. However, the market reaction could be entirely unpredictable. To be more precise, it may not correspond to the information received. The following day, many experts will once again be frantically trying to come up with explanations for what they observed on Wednesday evening and Thursday night. We continue to prepare for the appreciation of the British currency.

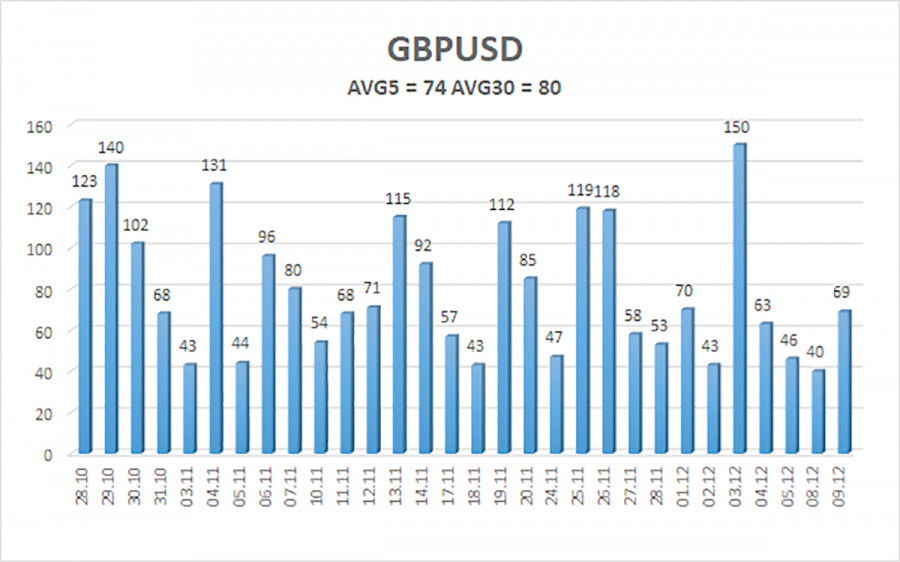

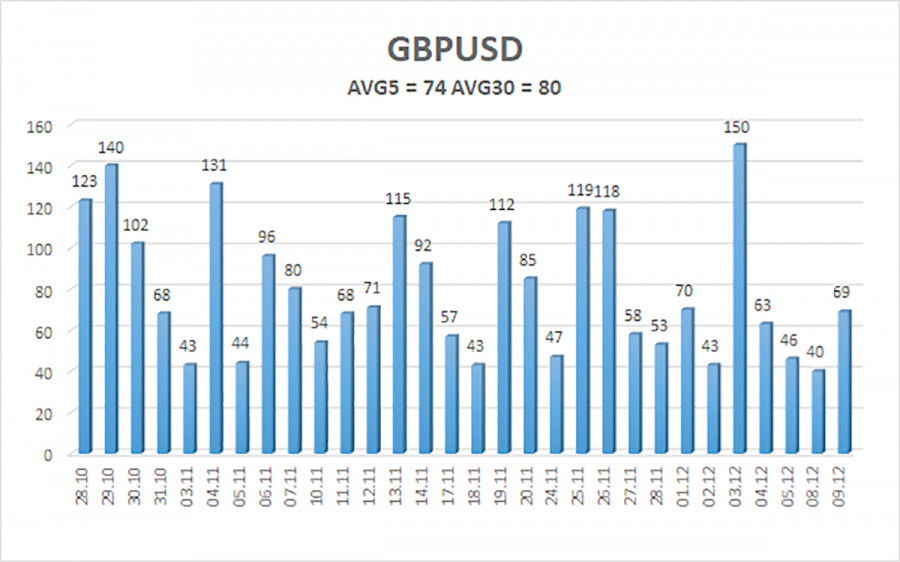

The average volatility of the GBP/USD pair over the last five trading days as of December 10 is 74 pips, which is considered "average" for this pair. We expect the pair to trade within the range of 1.3233-1.3381 on Wednesday. The upper channel of the linear regression is directed downwards, but this is only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold area 6 times over the past months and has formed several "bullish" divergences, constantly signaling a potential resumption of the upward trend. Last week, the indicator "visited" the overbought area, implying a possible downward correction.

Nearest Support Levels:

- S1 – 1.3306

- S2 – 1.3245

- S3 – 1.3184

Nearest Resistance Levels:

- R1 – 1.3367

- R2 – 1.3428

- R3 – 1.3489

Trading Recommendations:

The GBP/USD pair is attempting to resume the upward trend of 2025, and its long-term prospects have not changed. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the U.S. currency to appreciate. Therefore, long positions with targets at 1.3428 and 1.3489 remain relevant for the near future while the price is above the moving average. If the price is below the moving average, small short positions can be considered, with targets at 1.3233 and 1.3184, based solely on technical grounds. Occasionally, the U.S. currency shows corrections (in the global context), but it will require signs of the end of the trade war or other global positive factors for a trend to strengthen.

Illustration Explanations:

- Price Levels (Support/Resistance): Thick red lines where movement may end. They are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Strong lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour timeframe.

- Extreme Levels: Thin red lines where the price has previously bounced. These are sources of trading signals.

- Yellow Lines: Trendlines, trend channels, and other technical patterns.

- Indicator 1 on COT Charts: Represents the net position of each trader category.