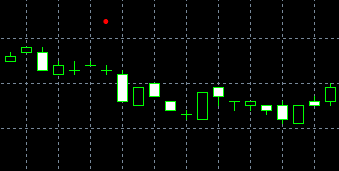

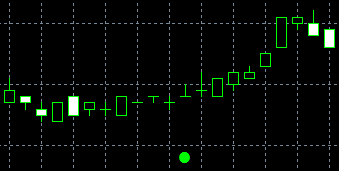

The Tri-Star is a strong pattern pointing to a reversal in the current trend and indicating strong resistance or support. The Tri-Star is formed by three doji candles, with the middle doji being a star. Steve Nison developed this pattern. It is quite rare, but it should not be ignored.

The reason for the trend’s reversal amid the Tri-Star is traders’ mass reaction to the market uncertainty, which is reflected by three dojis in a row.

How to determine Tri-Star

1. All three days are represented by dojis.

2. Between the second and the nearest days there is an up or down gap.

Scenario and psychology

An uptrend or a downtrend dominated in the market for a long time. Candles started to become shorter with the weakening trend. The first doji arouses concerns; the second doji means the market lost its direction; and the third one reflects the trend’s completion. Three stars on a chart point to deep confusion, and traders change positions despite their convictions.

Flexibility

Due to the pattern’s rarity, traders should pay great attention to the calculation data. If the second doji’s gap includes a shadow, it increases the pattern’s significance.

Development

The Tri-Star may develop into the Spinning Top pattern that reflects the market’s indecision.

There are no patterns similar to the Tri-Star because of its rarity.